The Silver Tsunami

Our local business landscape is going through a dramatic shift.

We must support retirement-age business owners to avoid simply closing up shop. Faced with the challenges of bridging this crisis, many business owners may feel that the best route is to close down; the investment of energy and capital may not feel worth it at the end of a long career as a small business owner. Since for most small business owners, the business is their retirement nest egg, they are faced with devastating choices.

We have the opportunity to keep many of these businesses locally-owned for the long term and to deepen their positive impact on our local economy.

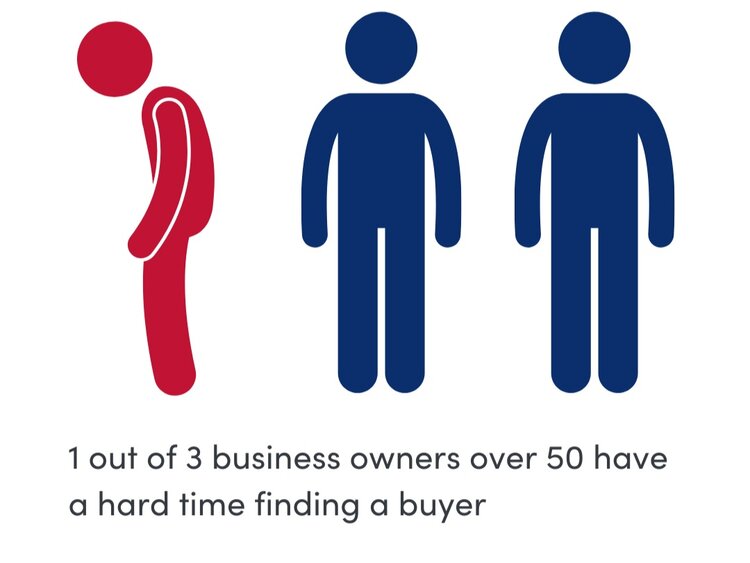

With almost half of all privately-held businesses with employees having owners over age 55 in Missouri, we will see a massive ownership changeover of locally-held businesses as the ‘Silver Tsunami’ of retirements marches forward. The vast majority (over 85%) of business owners do not have a succession plan in place, and increasingly, many are finding it hard to find a buyer when they are ready to sell. As a result, some of these companies will quietly close down, a very small percent will be passed on to family members, others will sell to another local owner, and some will be sold to a larger company or out of area buyer. Those in this last category will likely lay off employees and will further concentrate ownership and wealth.

Invest in Employee Ownership

Why it matters

Small businesses are the lifeblood of our economy, making up over 99% of all firms and providing around half of private sector jobs. Locally owned businesses circulate three times more money back into the local economy than absentee-owned firms or corporate chains. And local businesses are based on local relationships, fostering trust and civic engagement.

Employee ownership offers business owners a way to increase employee engagement now, and a path to a sale and to preserving their legacy, while at the same time deepening the impact of small businesses in our community.

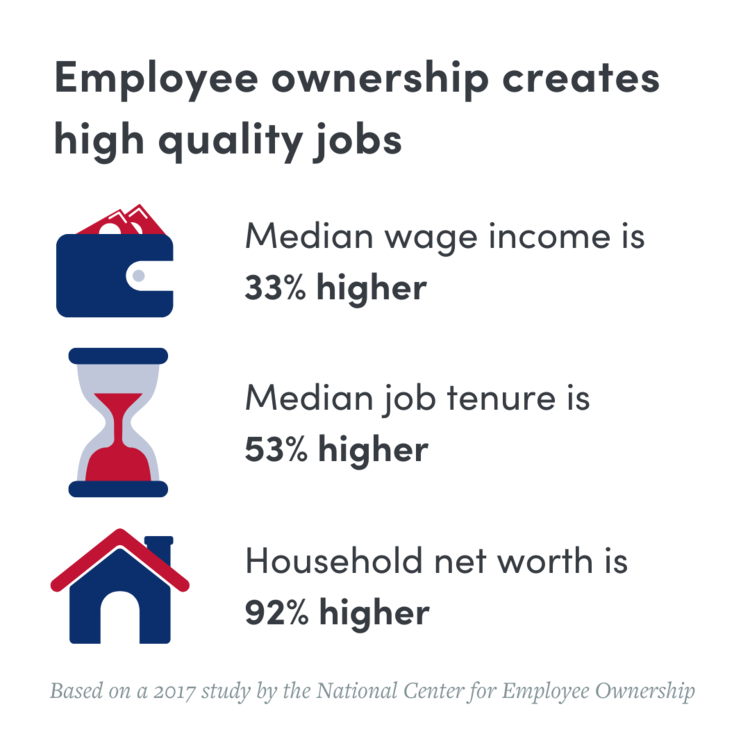

Broad-based employee ownership has tremendous benefits for workers, for businesses, and for communities. When successful businesses become employee-owned, they create high quality jobs, increase worker voice, and facilitate asset building for employee-owners—all while boosting business survival rates and keeping local economies strong. For more detail, see the publication, The Case for Employee Ownership.

Investing in employee ownership as part of our recovery agenda creates more resilient local economies with stronger small businesses and higher quality jobs.

Why it matters

We can all play a role in supporting local businesses and promoting employee ownership.

Raise awareness of the problem

-

Local governments can measure the impact on their tax base by using business license data to track how many businesses are over 15, 20 or 25 years old.

-

City and regional planners can convene local officials, business networks, lenders and others to determine how they are assessing and addressing this issue.

Engage businesses about employee ownership transitions

The benefits of broad-based employee ownership are clear, but most business owners do not know that selling their business to their employees is a great way to increase employee engagement and preserve the business’ legacy.

- Business service providers can add succession planning to their service offerings and include employee ownership as an option

- Cities can add succession planning into their economic development goals and partner with organizations that provide education and expertise on employee ownership

- Regional planners can integrate the stabilization of local business ownership into their goals

Interested in learning how businesses can transition to employee ownership and communities can keep good jobs?

LOCAL BUSINESSES ARE THE LIFEBLOOD OF OUR ECONOMY

Keeps local businesses open and grows good jobs

ABOUT MOCEO

and our partners

The Missouri Center for Employee Ownership is a 501c3 non-profit that exists solely as a free unbiased hub of education and resources on all forms of employee ownership. No need to become a member as we are not membership driven, you can save the work of researching on your own and turn to the Center for guidance on deciding if employee ownership is right for you.

Project Equity

As a national organization, Project Equity advocates for and raises awareness of broad-based, democratic employee ownership, and we support businesses in transitioning to this highly beneficial business model. Through amazing local partners like the Missouri Center for Employee Ownership, we support this work in regions across the country.