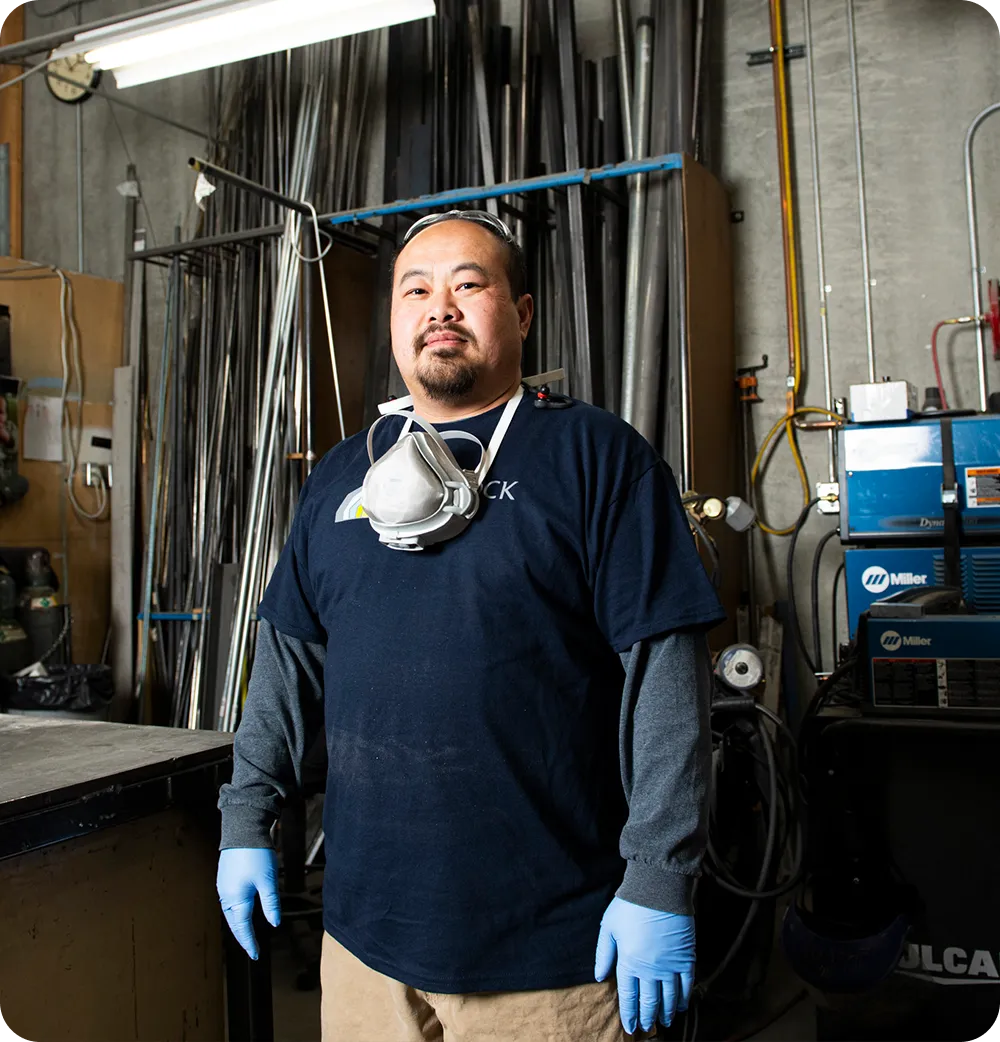

BUILDING A STRONGER FUTURE

THROUGH EMPLOYEE OWNERSHIP

Our Mission

Inform - Educate - Transition

Building a stronger future through ownership.

MOCEO is Missouri's go-to resource for all things employee ownership. Our mission is to educate business owners and their advisors on the benefits of employee ownership and help them explore the best path forward for their company’s future.

We provide expert articles, insights, and case studies to help businesses understand the impact of employee ownership. MOCEO also connects business owners with a trusted network of service providers who specialize in employee ownership transitions. Whether you're just starting to explore your options or ready to take the next step, we're here to guide you every step of the way.

Our Impact

Strengthening communities, preserving jobs, and building wealth through employee ownership.

Founded in 2020, MOCEO is part of a nationwide network under the Employee Ownership Expansion Network (EOX). Together, we are dedicated to making employee ownership a powerful tool for economic stability and wealth equity.

MOCEO helps business owners transition to employee ownership through education, resources, and expert guidance. These transitions not only preserve jobs but also strengthen communities and create lasting financial opportunities for employees, building a more inclusive and resilient economy for Missouri.

Mapping Missouri's Business Succession Crisis

Explore our interactive map to see the impact of the "Silver Tsunami"—

the wave of retiring baby boomer business owners putting over half of Missouri’s privately held businesses at risk.

This tool highlights communities in danger of losing local businesses, emphasizing the urgent need for succession planning.

Employee ownership offers a powerful solution to keep businesses thriving, preserve jobs, and strengthen our economy.

With baby boomers owning the majority of Missouri’s private businesses, now is the time to plan for the future.

See how employee ownership can be part of the solution!

Measuring the Movement

Employee Ownership by the Numbers

6500+

ESOP COMPANIES NATIONWIDE

180

ESOP COMPANIES IN MISSOURI

450+

WORKER CO-OPS NATIONWIDE

40

WORKER CO-OPS IN MISSOURI

Stay Informed

Stay informed about the latest in employee ownership and how it’s transforming businesses, strengthening communities, and creating lasting financial opportunities for employees.

Get expert insights, success stories, and important updates delivered straight to your inbox.

Subscribe today and be part of the movement shaping the future of business.

Whether you're a business owner, advisor, or advocate, staying connected ensures you have the knowledge and resources necessary to support

employee ownership in Missouri and beyond!

All Rights Reserved 2026